Online shopping is on the rise. Online transactions such as digital purchases and transfers take place daily, with customers often having to trust third-party services to ensure their money is safe. This can create a sense of uncertainty, leaving many shoppers wary of completing online transactions. Fortunately, escrow services exist that offer buyers and sellers enhanced security when it comes to digital payments and other types of transferable items. In this article, we will discuss why opting for an escrow service for your online transactions can have a number of benefits in terms of safety and reliability. We’ll look at what makes them different from regular payment methods, how they work in practice, why reputable providers should always be your go-to option and more. By the end, you’ll have all the tools you need to understand why using an escrow service for online transactions may be worth considering for your next purchase or sale!

What is an Escrow Service?

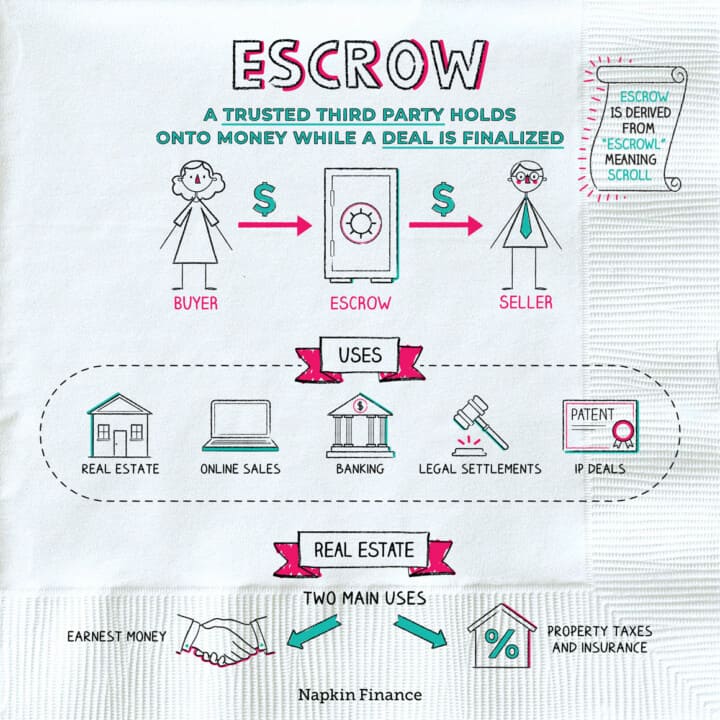

An escrow service is an independent third-party organization that facilitates the exchange of money and/or other tangible or digital items in a secure manner. This type of service is commonly used in transactions such as real estate, business purchase agreements, and online shopping. When these transactions take place through an escrow account, funds are held until both parties have completed their part of the agreement —with the buyer’s payment being released to the seller once all criteria from both sides have been met. By utilizing this process buyers and sellers experience greater peace of mind knowing that their money is safe (assuming they chose a reliable company) and verified before any funds can be affected.

In terms of online shopping specifically, an escrow service provides added assurance that customers will receive what they paid for; while also protecting those on the other side by acting as a financial safeguard against fraudsters who may engage in chargebacks or breach their written contracts with no intent to follow through with payments upon delivery. Escrow services essentially make sure each party receives what was promised by verifying items exchanged or delivered much like a live retail setting so users can trust they’re dealing with legitimate buyers/sellers when engaging via ecommerce sites.

The Benefits of Using an Escrow Service

Using an escrow service allows buyers to purchase items online with greater peace of mind, as it protects both parties from fraud and other deceptive activities. Escrow services guarantee that money is held in a secure account until the transaction is complete; if delivery of goods or performance of services does not occur, then the buyer’s payment remains safe. Plus, features like dispute resolution help alleviate purchaser concerns and offers additional security for both sides involved in a digital exchange. Funds can remain within the escrow company’s trust accounts until all conditions are met, eliminating any worry on either party’s behalf about being cheated out of their money or not receiving what was promised.

Not only do escrow companies provide customers with extra security but they also bring certainty to transactions by providing clear terms that must be met before payments are released. Furthermore nearly all reputable escrows are members of trade industry organisations such as The Independent Professional Appraisers Association (IPAA) which holds them strictly accountable when handling clients’ funds or proprietary information, adding another layer to protection against fraudulent activity while demonstrating commitment to ethical business practices.

How to Choose the Right Escrow Service for Your Needs

When purchasing items or services online, it is important to choose the right escrow service for your needs. Escrow services act as trusted third parties who are responsible for holding and distributing payments in accordance with an agreement between buyers and sellers. This can provide buyers with added security since they can be assured that their money will go directly to the seller once the transaction requirements have been met.

It’s essential to consider what payment options are available when selecting an escrow service provider. Some providers may only offer certain types of payments, such as credit cards or wire transfers, while others might allow multiple forms of payment depending on country regulations. Additionally, check if there are any limitations regarding the purchase amount you can make using a particular kind of payment method when using an escrow service and ensure that all fees associated with online transactions are clearly stated ahead of time and accepted by both sides before entering into a contract.

Finally, look into customer reviews and ratings provided by independent review sites or organizations before engaging in any transaction – this can help you determine the level of service that the company provides its clients which helps you make an informed decision about selecting an appropriate vendor for your needs. By researching several different vendors prior to making a selection and asking questions about their terms, pricing policies and customer support capabilities, you should find it easy enough to identify a reliable escrow provider suited to meet your specific needs every time!