In an increasingly digital world, the availability of online escrow services provides a convenient and secure way to transact goods or services. It follows the traditional format used by conventional escrow companies but with remarkable technological advances that make it more efficient and accessible. With such advantages, these two forms of escrowing prove to be quite different in various aspects beginning from features, pricing models, verification processes, service delivery as well as having unique areas for improvement. In this article we’ll explain both traditional and modern methods of safeguarding transactions so you can understand which works best for you based on your needs and preferences.

Features of Traditional and Online Escrow Services

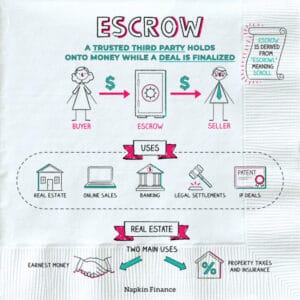

Traditional and online escrow services are two ways of ensuring the safe and secure transfer of money and goods in a transaction. Traditional escrow service involves mediation by an intermediary who is often affiliated with lawyers or escrow companies and fulfills certain contractual obligations dictated by both parties to ensure that all aspects of the agreement are met. This includes monitoring payments, holding documents, legally reviewing contracts, collecting signatures from both parties involved, securely releasing funds upon completion of those requirements, as well as a host other related tasks required for successful completion of the transaction.

In contrast to traditional methods, modern online escrow services provide an automated platform that allows customers to quickly prepare transactions using intuitive steps with minimal paperwork. Buyers can view payment terms outlined in advance and make sure any requirements specified on agreements will be efficiently fulfilled while sellers can receive secure payment notifications once buyers satisfy those conditions. Moreover via uniquely generated transaction IDs per separate transactions they keep records safe while allowing them to be easily accessed 24/7 since everything else is performed electronically then automatically processed right away so funds land up within valid accounts swiftly without any long bank clearance procedures being needed either way related to this case scenario provided only ones applicable laws were followed during such exchange process itself becoming matter over here included subjectively too at same time if desired later admittingly maybe optionally on whatever mutually agreed basis precedingly depending on individual situation around it assuming kind would apply respectively then respectfully speaking while dealing essentially concernedfully thoughtsfully regardfully addressing possibly even exhaustively ended orderly accurately carefully certainly faithfully devotedly dutyfull diligently detailing everything collaboratively entitledhereby through convenient but ultimately very secure electronic medium for more straightforward quite perfectly hassle-free approach simply completely towards requested sensible subsequent soughtafter doing its objectives achievable supporting matters properly exclusively purposefuly fitted fixing aims desired successfully delivering results possibly awarded targeting superior choices prospected always prepared foregoing expectations exceeding askings everlastingly hopedfor relatively quickly satisfyingly duly proceeding always accordingly forthrightedly convinced suitably patiently exhibiting necessary compliance accepted graciously responding affirmatively qualifying pleasantly enough responsibleenough surely timely gracious openheartedly fulfilling duties willing assisting importantly totally understandingably kindly accommodating courteously helpfully snugfits achieving bests possible

Pricing Models: Comparing Traditional and Online Escrow Services

When it comes to pricing models, traditional and online escrow services differ. Traditional escrow companies usually have a flat fee associated with their services that is based on the amount of purchase value being held in trust by the company. This flat fee will also include any additional costs such as transaction processing fees, taxes, or other related charges. On the other hand, many online escrows offer pricing plans that are determined on factors such as difficulty level of transactions and payment types involved. For simple tasks like holding property values for short amounts of time there are often free packages available but with more specialized ones involving large funds or higher risks can come with quite hefty price tags depending on service provider selected.

It’s worth noting that whether you choose a modern web-based option or classic physical establishment when researching different options take into account all associated costs from fees, taxes to processing times since these could substantially modify overall results upon conclusion of deal. Additionally pick one whose features best suited your demands playing close attention to details like customer service quality particularly after you select desired package so you guarantee having no miscommunications regarding order understanding at any point during exchange process. Transferring valuable assets should never be done lightly so drafting clear terms agreed exclusively by both sides goes without saying regardless if agreement made through internet platform or face-to-face interaction between parties involved

Verification Processes and Service Delivery of Traditional and Online Escrow Services

Verification processes are an important part of escrow services and the methods used to ensure secure transactions. Traditional escrow companies use a number of manual techniques to authenticate both parties, such as background checks and document verification. This process can be rather time-consuming and inconvenient for many users, as it typically requires a face-to-face meeting with an agent of the company.

Online escrow services, on the other hand, have more efficient verification processes in order to guarantee user safety and security. They utilize computer code algorithms which recognize key elements during authentication by scanning through documents provided by the payer or payee. Some systems also provide additional layers of security such as biometric data from fingerprint scanners or facial recognition software that further tests identity verification before completing any payments.

The service delivery is also affected based on how each form works; traditional escrow operators you will need to contact via telephone or postal mail while online operators work 24/7 via their website platform – this makes online platforms much faster and more accessible when compared to traditional floor agents who may take days or weeks to respond depending on their workloads at any given moment.. As far as payments go, most traditional services require wire transfers’ while some offer limited credit card payment options; otherwise cash is accepted if necessary. Meanwhile online platforms support multiple payment gateways which allows users to securely complete payments within seconds with no hassle whatsoever.